All Bark and No Bite: Climate Finance in Canada

November 25, 2024

- •

- •

- •

Findings from an April 2024 report by Oil Change International and Friends of the Earth, show that Canada remains a global leader in financing the oil and gas industry.

By Phillip Meintzer.

Read the PDF version here.

A growing number of Canadians seem to believe the federal government is intent on “killing” Alberta’s oil and gas industry. But a series of recent reports show that those claims are far from the truth.

It’s not just Alberta’s Energy Regulator — a public entity that is supposed to weigh the benefits versus harm of energy projects before approving them — that seems to be held captive by corporate interests in the oil patch. Canada’s federal government continues to pour public money into the fossil fuel industry despite promises to eliminate this kind of spending. Findings from an April 2024 report by Oil Change International and Friends of the Earth, show that Canada remains a global leader in financing the oil and gas industry.

From 2020 to 2022, the G20 countries — including Canada — provided at least $142 billion (USD) in public finance for fossil fuel companies or projects. That’s at least $47 billion (USD) in new funding per year, with most of that money going towards natural gas projects.

The report also found that the top three fossil fuel financers between 2020 and 2022 were Canada ($10.9 billion per year), Korea ($10 billion per year), and Japan ($6.9 billion per year), with the worst offenders coming from a group of financial institutions known as Export Credit Agencies (ECAs).

ECAs, like Export Development Canada, a federal crown corporation, help facilitate international exports for domestic companies. The report shows that ECAs accounted for 65 percent of all known fossil fuel financing activities within the study period.

The report notes that its numbers are likely underestimated because government reporting is limited and inconsistent, so the actual values are likely higher. Their analysis shows that a handful of countries, like Canada, are blocking a just and equitable transition to more sustainable forms of energy by continuing their financial support for the fossil fuel industry. This is money that could be used to accelerate a clean energy transition but instead keeps us locked into the fossil energy system that’s driving climate change.

Another recent report, released in March 2024 by Environmental Defence Canada, tracked how much financial support the federal government (and crown corporations) gave to fossil fuel companies in 2023. The report included grants, tax breaks, loans, and loan guarantees to come up with the totals.

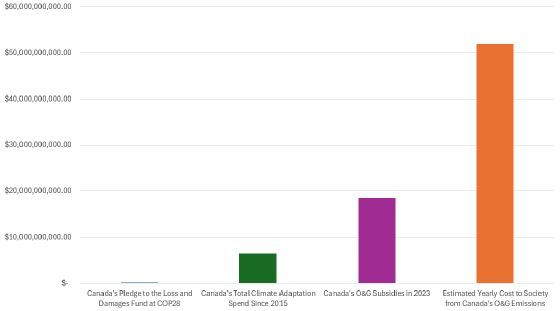

The analysis found that in 2023 alone, Canada provided at least $18.55 billion (CAD) in financial support to fossil fuel and petrochemical companies. This total included $8 billion in loan guarantees for the Trans Mountain expansion pipeline (better known as TMX), $7.4 billion in public financing through Export Development Canada, over $1.3 billion for carbon capture projects, and approximately $1.8 billion in assorted tax breaks.

These findings show that over the last four years, the federal government gave the oil and gas sector at least $65 billion. The authors note this money could have funded every major wind and solar project developed across Canada from 2019 to 2021 twelve times over. It also represents 10 times what the federal government has invested in climate change adaptation since 2015.

In July 2023, the federal government announced that Canada was the only G20 country to phase out inefficient fossil fuel subsidies two years ahead of the 2025 deadline. But despite that claim, Canada still gave at least $18.55 billion to the fossil fuel industry that same year. That’s $18.55 billion of taxpayer money that was gifted to fossil fuel companies to boost their profits when it could have been spent on renewables or much-needed public services. As the harmful impacts of the climate crisis continue to worsen, Canada continues to pour more fuel on the fire.

Using the Government of Canada’s Social Cost of Greenhouse Gas Emissions (SC-GHG) tool, Environmental Defence also measured the cost to society from the pollution produced by Canada’s oil and gas companies in 2023. Estimates from the SC-GHG include costs for climate damages such as changes to agricultural productivity, human health effects, property damage from increased flood risk, and impacts on the ecosystem. The analysis found that the social cost of Canadian oil and gas pollution in 2023 alone was approximately $52 billion.

Last December, during the 2023 United Nations Climate Change Conference (COP28) in Dubai, Canada proudly pledged $16 million toward a new global fund to address losses and damages from climate change. This fund is intended to support the most vulnerable countries and communities in the over-exploited global south who are on the front lines of the most harmful impacts of climate change, and which are predominantly driven by emissions from countries in the global north, such as Canada and the United States.

But a paltry $16 million pledge towards losses and damages is laughable when you’re also giving $10.9 billion per year (on average) to the industry directly responsible for the emissions creating those very damages. It’s almost disrespectful when the estimated societal cost for a single year of Canada’s oil and gas emissions is $52 billion, more than three thousand times the amount that Canada pledged to the fund. Canada is not the climate leader it wants the world to think it is.

In 2022, the top four oil companies in Canada (Cenovus, Imperial Oil, Suncor, and Canadian Natural Resources) posted combined profits of $33.7 billion. And again, in 2023, these same four companies recorded profits of over $25 billion. These two years were the most profitable in the history of Canada’s oil and gas industry. These private companies don’t need our tax dollars to survive. If anything, we should be taxing them more to help fund the transition to renewable energy and pay for public services that are constantly subject to smaller operating budgets.

Fossil fuel corporations aren’t alone in profiting at the expense of a habitable planet. Banks who finance their operations, like the Royal Bank of Canada (RBC), are benefiting from it.

According to the 2024 edition of the annual Banking on Climate Chaos Report, RBC was the world’s leading financier of oil sands companies in 2023 at $523 million.

The report includes RBC alongside large American banks like JPMorgan Chase as “The Dirty Dozen” banks with the worst record for financing fossil fuels since the Paris Agreement was signed in 2015. Overall, RBC invested more than $28 billion into fossil fuels in 2023, bringing its total to $256.45 billion over the last eight years.

To put this in an Alberta context, RBC is the largest institutional shareholder of Suncor Energy Inc., the same oil sands company that is planning to expand its Fort Hills mining operation into the beautiful, ecologically significant McClelland Lake Wetland Complex starting next year. Since 2016, RBC has invested around 2.8 billion into Suncor, with more than $500 million of those funds provided in 2023 alone.

Oil sands mining projects, like Suncor’s Fort Hills mine expansion, are not possible without massive financial support from banks in the form of loans and investments. And through these investments, RBC is helping to enable the ongoing destruction of ecosystems in northern Alberta. Suncor might be doing the digging at McClelland, but RBC is making it possible. Yet, this is hardly surprising. Canada’s National Observer found that nearly one in five board directors at Canada’s big five banks sit on the boards of fossil fuel companies as well.

Given the outsized role that Canadian banks play in funding climate change, the CEOs of Canada’s big five banks were recently summoned to testify in front of a federal parliamentary committee back in June. This was an opportunity for federal decision-makers to question those in charge of Canada’s banks and may lead to stronger regulations that align banking practices with our international climate goals. That is, if our legislators dare to hold the banks accountable. But if Canada’s track record with the fossil fuel sector is anything to go by, it seems unlikely that the federal government will be bold enough to demand our fair share of this immense wealth.

A Globe and Mail article from April 15, 2024, reported that federal officials dropped a plan for a surtax on oil and gas producers after “strong opposition from oil patch executives.” This was at the same time the Canadian Association of Petroleum Producers (a Calgary-based industry lobby group), reported record returns in the fossil fuel industry this year.

It seems that Canada is held captive by the fossil fuel industry as it continues to prioritize corporate profitability at the expense of Canadian taxpayers, our public services, healthy ecosystems, and those most at risk of the harmful impacts of climate change such as Indigenous Peoples and communities in the global south.

University of Manitoba professor David Camfield, in his 2023 book Future on Fire: Capitalism and the Politics of Climate Change states that: “Trudeau is a master of the art of appearing to be serious about addressing climate change while implementing policies that promote fossil fuel extraction. The Liberal government’s climate plan, which combined ‘weak emissions targets, promised investment in clean technologies, and a market-based carbon price,’ was one that oil and gas firms and the rest of corporate Canada could accept, no matter what Trudeau’s Conservative opponents said.” The federal government’s continued subsidizing of the fossil fuel industry only further exemplifies their contradictory approach to climate policy.

Promises are meaningless without tangible action to back them up. Despite Canada’s many international commitments, the evidence shows that our federal government is still prioritizing profitability in the oil patch over meaningful action on climate change.

To those who think Canada’s government is anti-oil and gas, I suggest you think again.